800V "Perfect Match" Silicon Carbide

Release time: 2022-01-20

Source:

In October, The Wall Street Journal reported that the global automotive industry is investing billions of dollars in chips made of silicon carbide (SiC) material.

For example, General Motors Vice President Sherpan Amin said, "Electric vehicle users are pursuing longer range, and we consider silicon carbide as an important material in power electronics design

Before saying this, General Motors had already reached an agreement with Wolfsburg, headquartered in Durham, North Carolina, to use the silicon carbide devices produced by the latter.

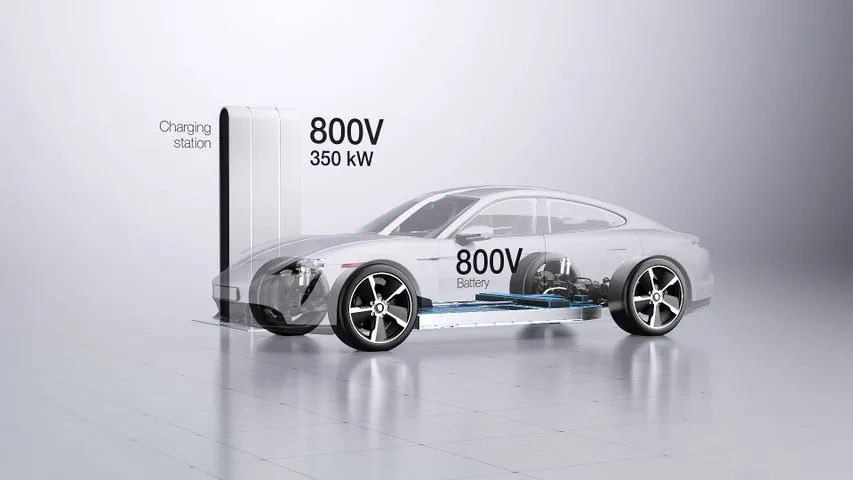

And complementary to it is the rise of silicon carbide, which is considered a "perfect match" with the 800V high-voltage platform system being promoted in the automotive industry. Under the trend of approaching the 800V high-voltage platform, the industry expects that SiC power components will enter a rapid explosive stage in the coming years with the large-scale deployment of the 800V platform.

Why do you say that? Because on platforms of 800V or even higher, the original silicon-based IGBT chips have reached their material limits, while silicon carbide has advantages such as high voltage resistance, high temperature resistance, and high frequency resistance, making it undoubtedly the best alternative to IGBT.

As the hottest third-generation power semiconductor materials this year, silicon carbide (SiC) and gallium nitride (GaN) are applied in higher-order high-voltage power components and high-frequency communication components, representing the main materials of the 5G era. Especially silicon carbide, it can be said to be a collection of "countless favors".

Of course, a major challenge facing silicon carbide is its high price. And how to ensure the cost saving benefits achieved with silicon carbide chips, overcoming the disadvantage of high production costs of silicon carbide chips, has become the most important task at present.

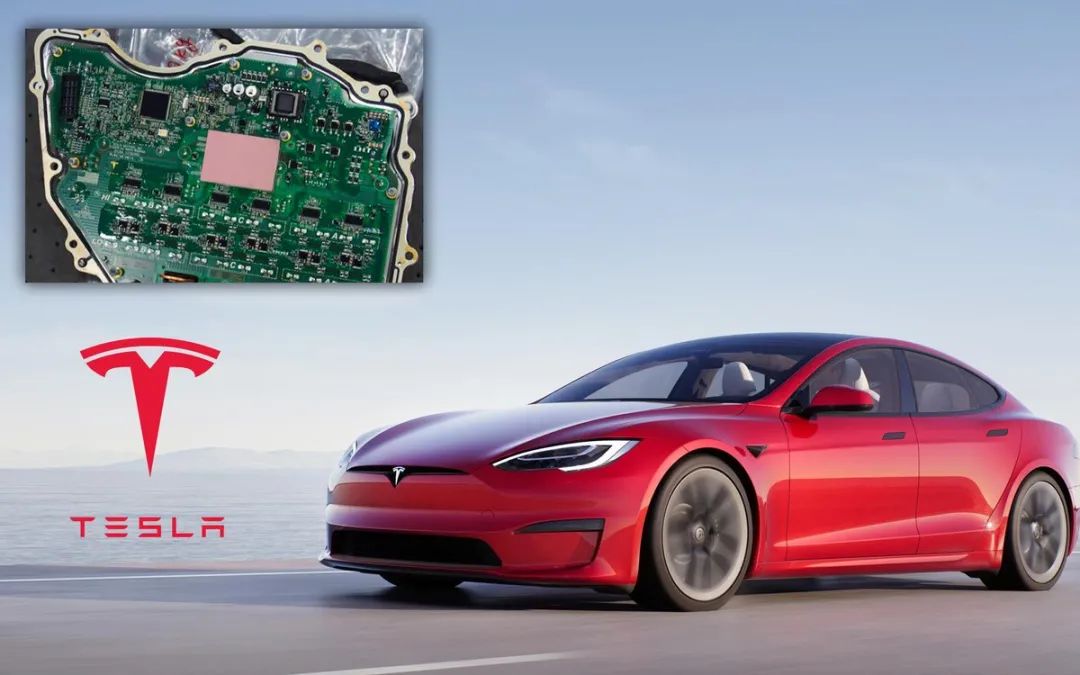

As the saying goes, the power of role models is infinite, just like what Tesla has done - Tesla has been using silicon carbide in its power control chips for years, resulting in reduced energy loss, more powerful engines, and increased range. From the perspective of TCO (Total Cost of Ownership), the cost of a bicycle has actually decreased significantly.

In fact, with the current trend of SiC+800V, it is unclear whether silicon carbide achieved 800V or 800V achieved silicon carbide. What we can confirm is that silicon carbide is becoming mainstream as a replacement for IGBT.

Advantages of Silicon Carbide

In terms of price, the current international price of SiC is 5-6 times that of corresponding silicon-based products, and it is decreasing at a rate of 10% per year. It is predicted that as market supply increases in the next 2-3 years and prices reach 2-3 times that of corresponding silicon-based products, the advantages brought by reduced system costs and improved performance will gradually drive SiC to replace silicon-based IGBT and other products.

According to a report by The Wall Street Journal, "Researchers estimate that depending on the type of electric vehicle, silicon carbide related technology can help a car ultimately save $750 in battery costs." Some also estimate that using SiC will result in a total cost reduction of approximately $2000. However, the cost of silicon carbide materials is approaching that of silicon-based materials, and it is estimated that it will take several more years.

The reason for the high price of silicon carbide is simple, because it is difficult to manufacture. Why is silicon carbide so difficult to produce? It can be said that the harder a diamond is, the harder it is. So, the manufacturing cost of silicon carbide remains high in the short term.

However, the advantages of silicon carbide are very clear. For example, volume reduction is one of them, and Toyota's silicon carbide components have a volume reduction of 80% compared to silicon-based ones. In addition, according to relevant analysis data, in terms of range, compared with electric vehicles using silicon-based chips, electric vehicles equipped with SiC chips have an average extension of 6% in driving distance.

For example, in China, the SiC module of BYD Han EV reduces its volume by more than half compared to silicon IGBT and doubles its power density under the same power condition. Moreover, according to BYD's plan, all electric vehicles under BYD will fully replace IGBT with SiC power semiconductors by 2023. The trend of silicon carbide is really unstoppable.

However, when it comes to the large-scale application of silicon carbide, it began with Tesla.

In 2018, Tesla replaced IGBT modules with silicon carbide modules for the first time in Model 3. After use, at the same power level, the packaging size of silicon carbide modules is significantly smaller than that of silicon modules, and the switching loss is reduced by 75%. Moreover, when converted, using SiC modules instead of IGBT modules can increase system efficiency by about 5%.

Of course, in terms of cost, this is not cost-effective. After replacing the power components of the inverter with IGBT and silicon carbide, the procurement cost increased by nearly 1500 yuan. However, due to the improvement of overall vehicle efficiency, the installed capacity of batteries has decreased, saving costs again from the battery end.

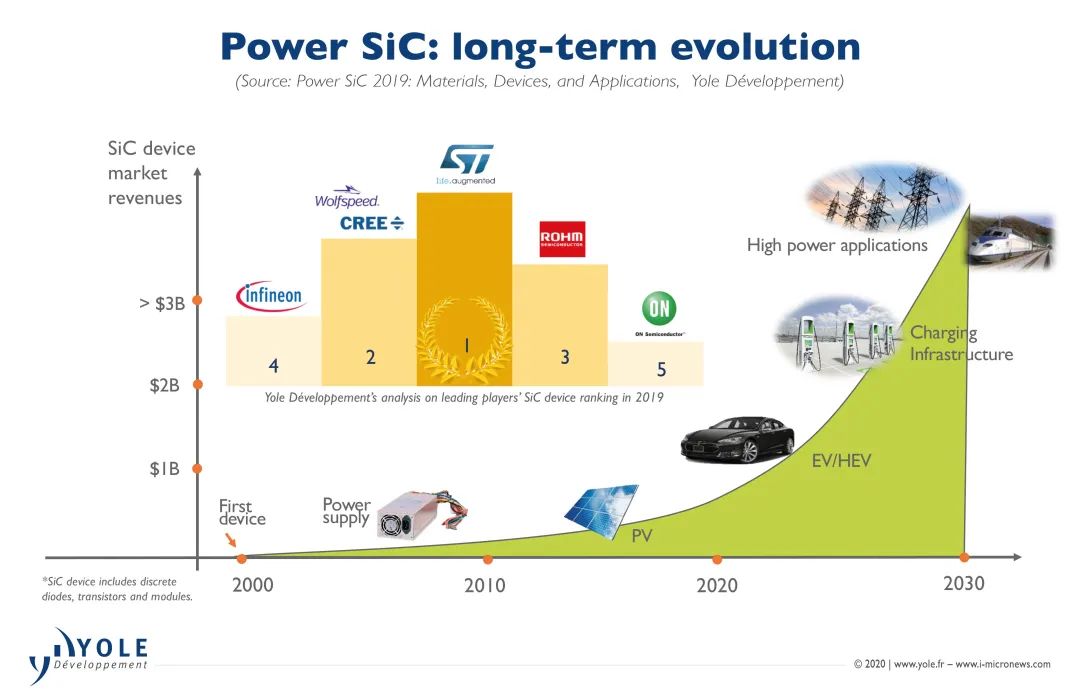

In terms of development history, the world's first silicon carbide power semiconductor SiC MOSFET was launched in 2011. Prior to this, the American company Cree had undergone nearly 20 years of research and development, which could be described as a "difficult production". Ten years later, SiC finally ushered in the "explosion year".

Cree CEO Gregg Lowe also confirmed that the company is expected to build the world's largest silicon carbide plant by early 2022, enabling it to fully leverage growth opportunities in the coming decades.

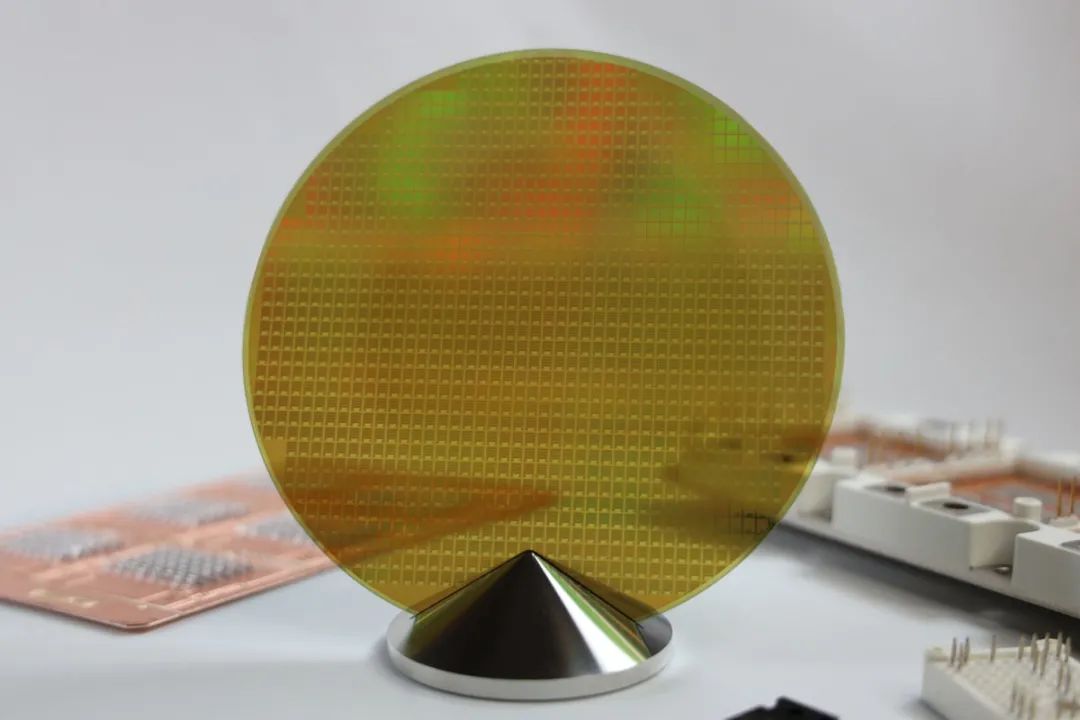

Before the arrival of the 8-inch era, there was an imbalance between supply and demand

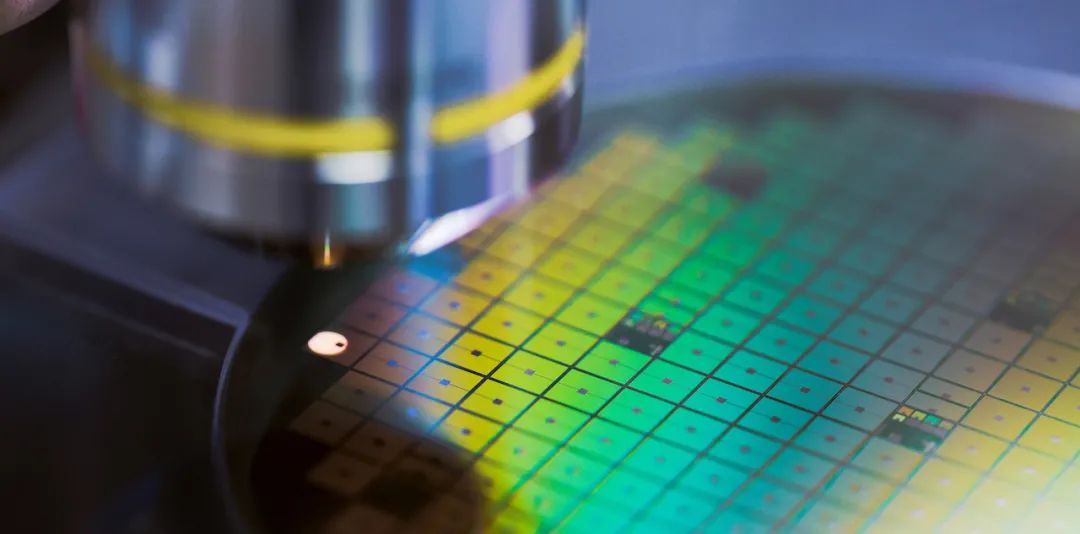

In terms of production technology, the current main production size of silicon carbide is 6 inches, which is 150mm. However, the industry is still making rapid progress. On August 11th, STMicroelectronics (ST) announced that its Norrk ö ping factory in Sweden has manufactured the first batch of 8-inch silicon carbide wafers.

It is reported that the first batch of 8-inch SiC wafers from ST have excellent quality, with very low chip yield and defects such as crystal element errors. The low defect rate is attributed to ST's deep accumulation of research and development technology in SiC silicon ingot growth technology. In addition, ST is collaborating with upstream and downstream technology vendors in the supply chain to develop exclusive manufacturing equipment and production processes.

Marco Monti, President of ST's Automotive and Discrete Component Products Division, stated that the automotive and industrial markets are accelerating the process of electrification of systems and products, and upgrading to 8-inch SiC wafers will bring significant advantages to ST's automotive and industrial customers.

And from 6 inches to 8 inches, this also represents another step forward in improving the lightweighting and energy efficiency of power electronic chips. However, although the 8-inch (200mm) production line has already started mass production, it will take some time to fully enter the 8-inch era.

However, a reality is that the sudden surge in demand for silicon carbide power components in the current market has further caused a global shortage in the silicon carbide supply chain.

At present, only one silicon carbide wafer can equip two electric vehicles. That is to say, with the current global annual production capacity of 600000 silicon carbide wafers, it can at most meet the demand for 1.2 million electric vehicles. This doesn't even include applications such as charging stations. According to research by TrendForce Consulting, it is expected that the global demand for 6-inch SiC wafers will reach 1.69 million pieces by 2025.

Take another look at Tesla. In 2020, Tesla delivered nearly 500000 electric vehicles worldwide; The delivery volume in the first half of this year has reached 386000 vehicles, and by the end of the year, it is expected that the annual delivery volume will be at least 750000 vehicles. That is to say, the current global production capacity of silicon carbide wafers, after meeting Tesla's needs, is not much left.

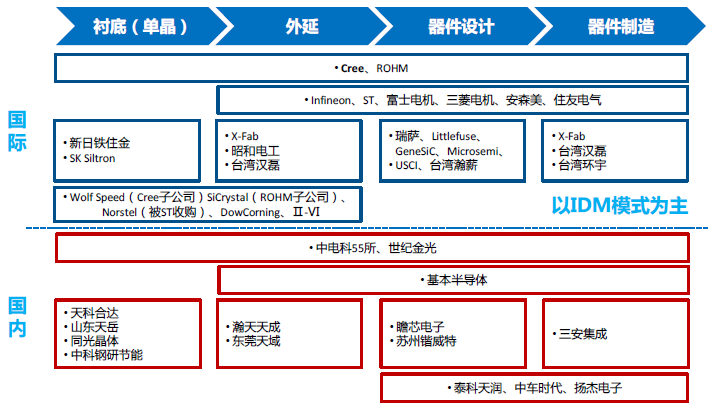

So, who are the main players in the global silicon carbide wafer industry? According to the shipment volume in the first half of 2020, CREE holds a global market share of 45%, SiCrystal, a subsidiary of ROHM in Japan, holds 20%, and II-VI holds 13%; The market share of Chinese enterprises is still relatively low, with Tianke Heda accounting for 5.3% and Shandong Tianyue accounting for 2.6%.

From the overall perspective of the silicon carbide industry chain, the main links such as SiC substrates, EPI epitaxial wafers, devices, and modules are currently monopolized by foreign countries in the global silicon carbide market. According to Yole data, Cree, Infineon, and Romco hold approximately 90% of the SiC market share.

Here, let's popularize that there are two major processes that are important components of the manufacturing cost of SiC devices. Among them, the cost of SiC substrate accounts for about 47% of the total cost, and the cost of SiC epitaxy accounts for 23%. However, the preparation of SiC substrates is limited by various issues such as slow growth rate of SiC crystals, difficult process control, multiple growth types, and difficulty in cutting, resulting in low global production capacity.

In terms of substrates, the international mainstream has transitioned from 4-inch to 6-inch, and Cree, as the main supplier of substrates, has developed 8-inch substrates. Domestically, the main suppliers of substrates include Tianke Heda and Shandong Tianyue, which can supply 3-6 inch single crystal substrates.

In terms of epitaxial wafers, Xiamen Hantiancheng and Dongguan Tianyu Guang in China are already able to provide 4-inch/6-inch SiC epitaxial wafers. At present, 6-inch silicon carbide epitaxial wafers can be supplied locally. Of course, overall, the imbalance between supply and demand will continue to be the mainstream for a period of time in the future.

800V "Year One"

In fact, silicon carbide+800V is coming together. We can also say that if 2021 is the "first year" of silicon carbide, then 2022 will be the "first year" of 800V.

At this Guangzhou Auto Show, we saw that 800V is becoming a trend. It is not by chance that companies such as BYD e-platform 3.0, Dongfeng Lantu, Geely SEA Haohan Architecture, Hyundai E-GMP, Mercedes Benz EVA, and General Motors Outlander have all chosen 800V high-voltage platforms.

From the perspective of mass production time, new cars based on the 800V system from major automakers will be launched one after another in the next two years, although the actual 800V products are expected to arrive around 2024.

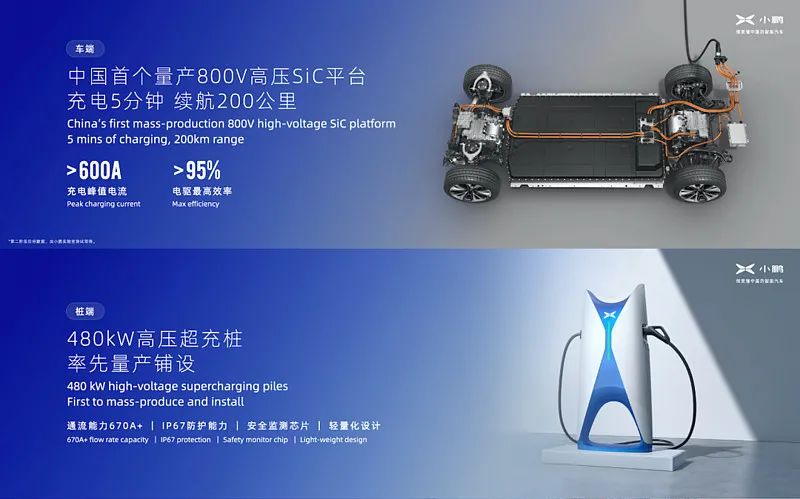

Specifically, the all-new SUV Xiaopeng G9, which made its debut at the Guangzhou Auto Show, features an 800V high-voltage SiC platform for the first time. It is reported that Xiaopeng Motors will also install China's first batch of mass-produced 480kW high-voltage supercharging piles to achieve the goal of running 200 kilometers in 5 minutes of charging.

Similarly, the first model of Great Wall's Salon Motors, MechDragon, also supports 800V super fast charging with a peak current of up to 600A. After charging for 10 minutes, it can achieve a CLTC range of 401 kilometers. There is also Zero Run, whose 800V platform will be mass-produced in the fourth quarter of 2024. Guangzhou Automobile Group also released the 480kW high-voltage charging pile developed by Wancheng Wanchong for it.

According to relevant predictions, the compound growth rate of the domestic 800V industry is expected to exceed 70% from 2023 to 2025, and enter a steady growth stage from 2025 to 2030, with a compound growth rate of about 20%.

So, why has the 800V architecture become mainstream? It is still because the 800V architecture solves two major pain points, one is to greatly improve the charging performance, and the other is to improve the overall operating efficiency of the vehicle.

On the 800V platform, thinner charging wires can be used. We know that under the same charging power, if the voltage is high, the current can be low, and if the current is low, the wire does not need to be so thick, and the resistance and thermal energy consumption of the wire are also reduced. If the same charging wire size as the original 400V is still used, the charging power can be increased.

Of course, under 800V high voltage charging, the series parallel configuration of the battery itself must also be readjusted, that is, the voltage of the battery pack must be relatively increased to 800V, otherwise it will burn out due to high charging current. In addition, systems such as electric drives, power electronic devices, and charging systems also require the use of 800V.

And higher overall operating efficiency refers to the fact that when the current remains constant, the higher the battery voltage, the greater the power of the motor, and the higher the efficiency of the motor drive. So, the 800V high-voltage platform is easy to achieve high power and torque, as well as better acceleration performance.

However, although the development of SiC+800V technology has painted a bright future for new energy vehicles and future travel, there are still certain difficulties in its implementation. For many car companies, launching an 800V product at a car show without supporting infrastructure is more of a conceptual call, and they will still face practical problems afterwards.

So, although it is said that "technology lights up life", the 800V platform not only requires research and development, but also means that many components of electric vehicles need to be redeveloped and designed, as well as the layout and construction of high-voltage charging networks from scratch. There is still a long way to go before the product is truly popularized. Ideals are full, but in reality, patience is still needed.